Ria Money Transfer

Designed an intuitive onboarding sign-up flow for Ria Money Transfer, a global leader in international financial services, catering to both enterprise and consumer users.

Objective

Put yourself in the shoes of a Product Manager and Designer working with a wallet software company or neobank in Europe. Your goal is to define and design a compliant and seamless onboarding flow for new customers on Desktop.

Discovery Process

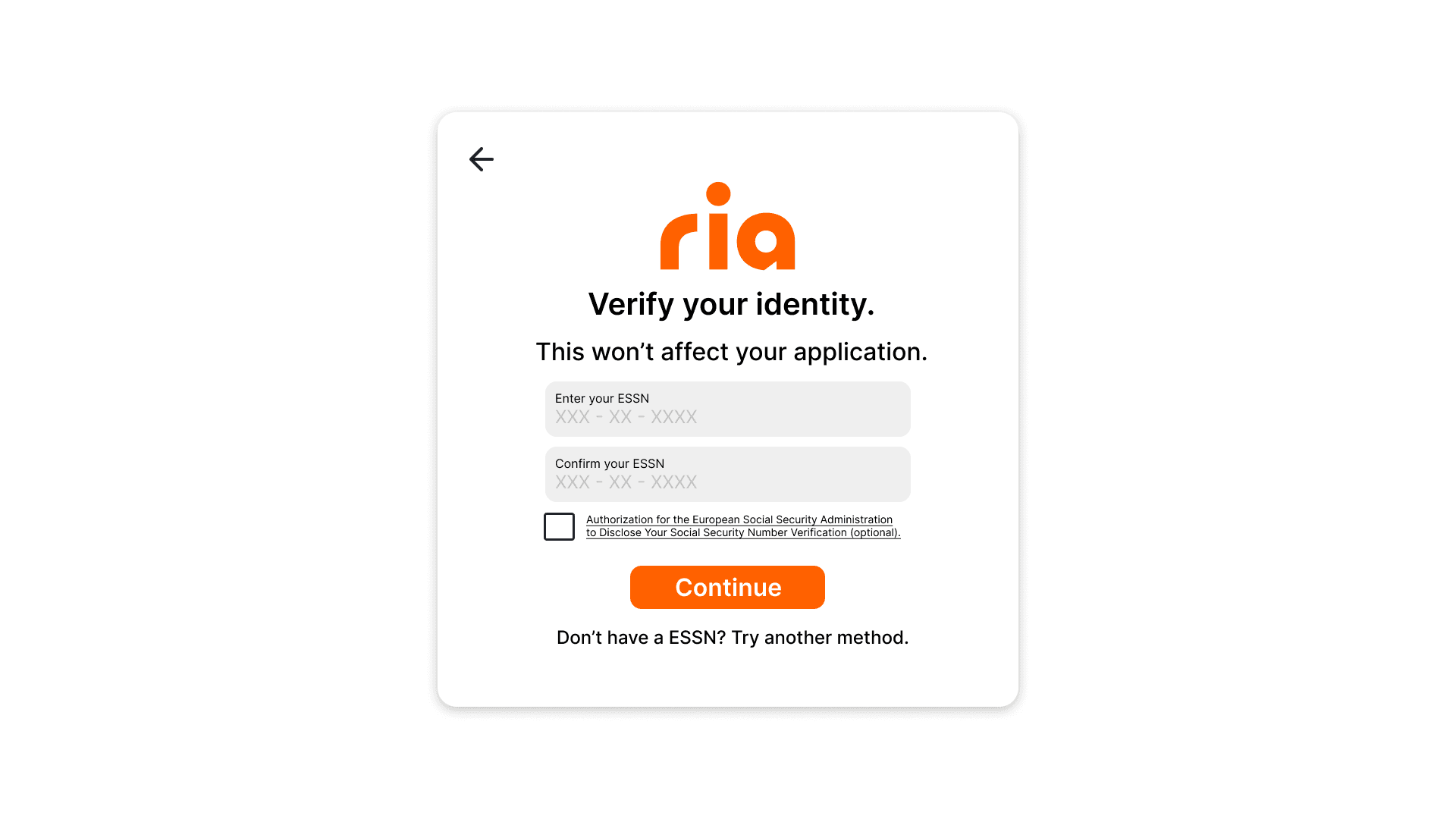

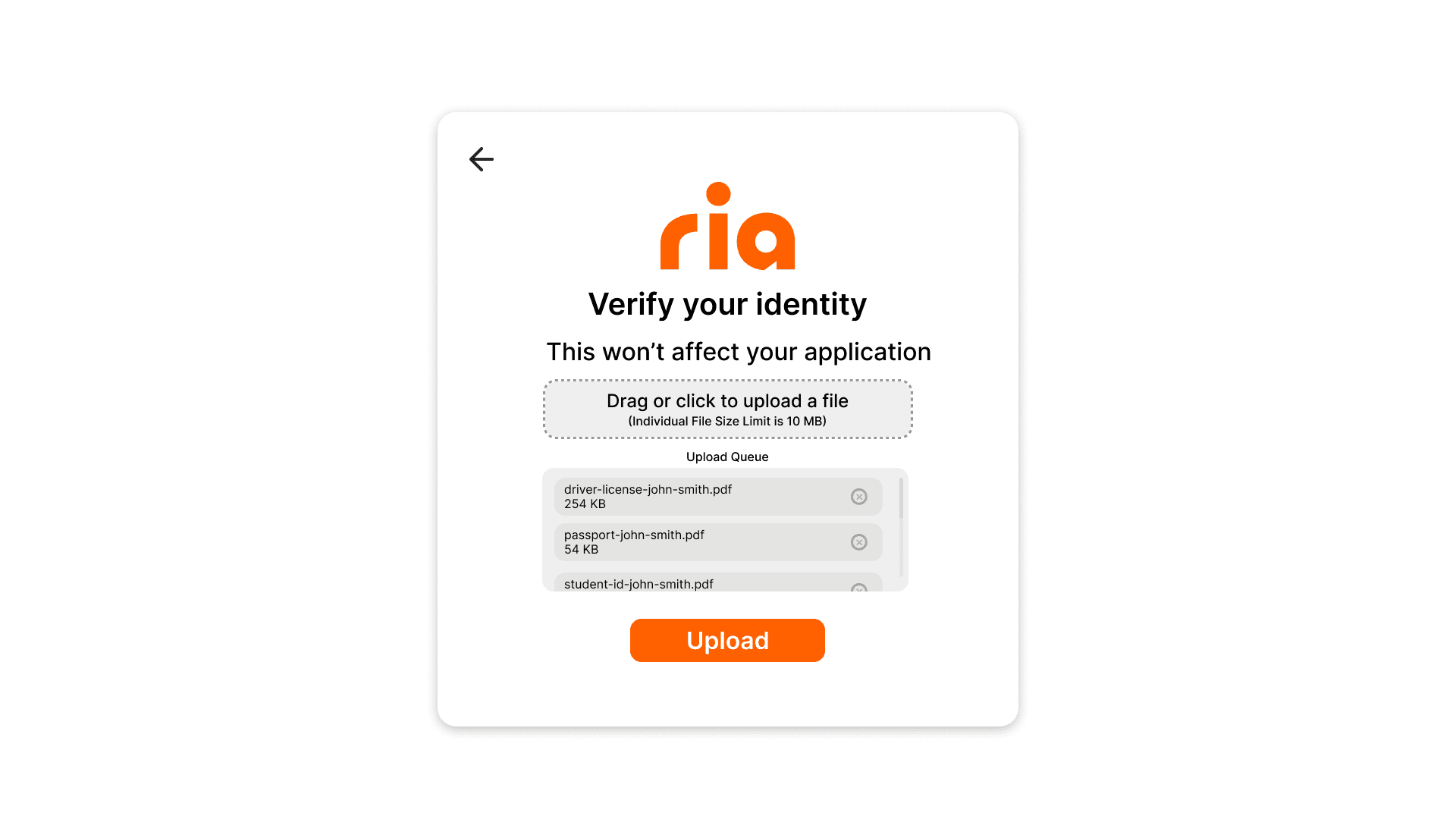

Europe enforces strict financial regulations, particularly around KYC (Know Your Customer) and AML (Anti-Money Laundering). Managing a digital wallet or neobank in this region requires the onboarding experience to be compliant to avoid legal violations while minimizing user drop-off.

User Flow

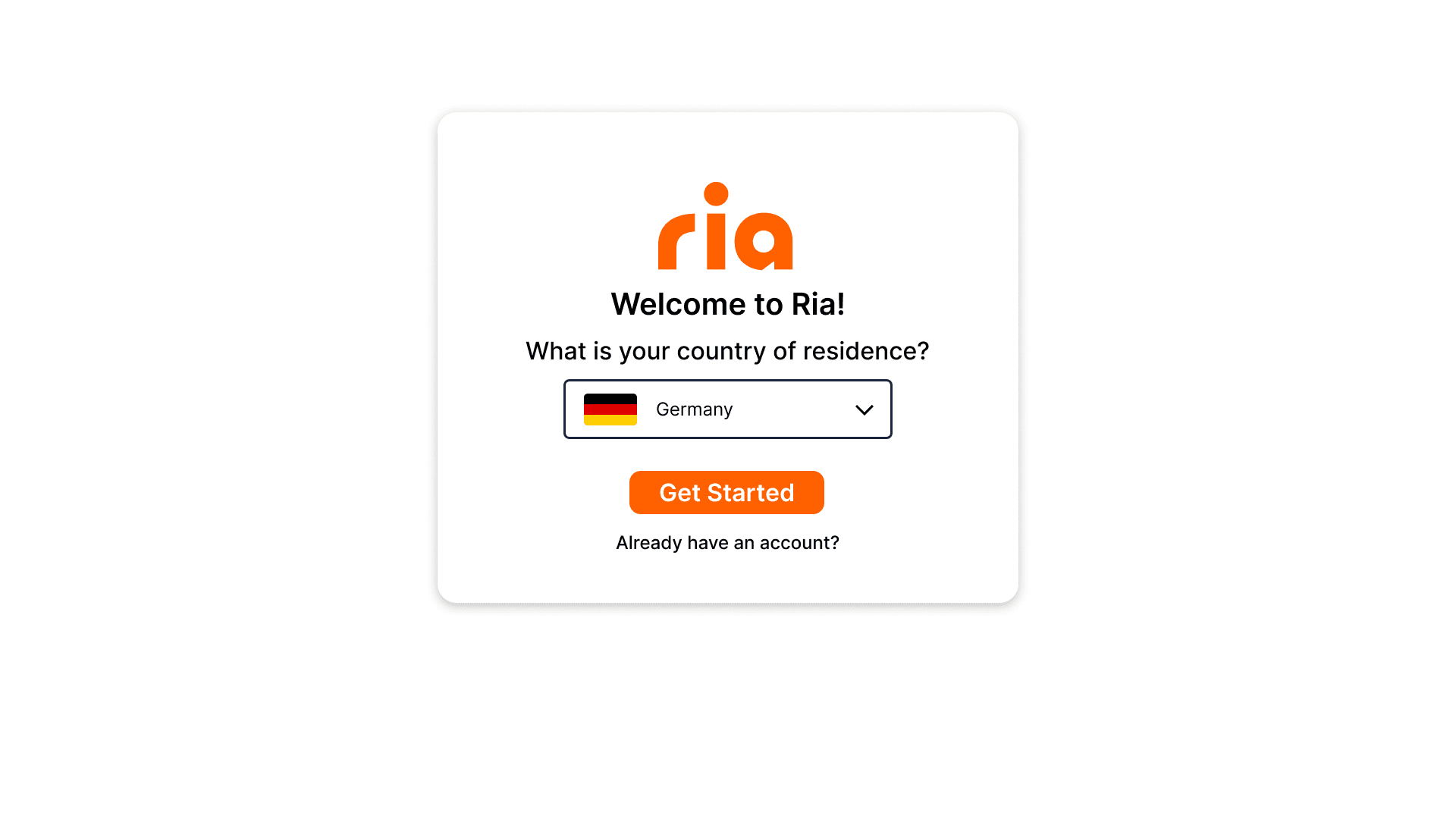

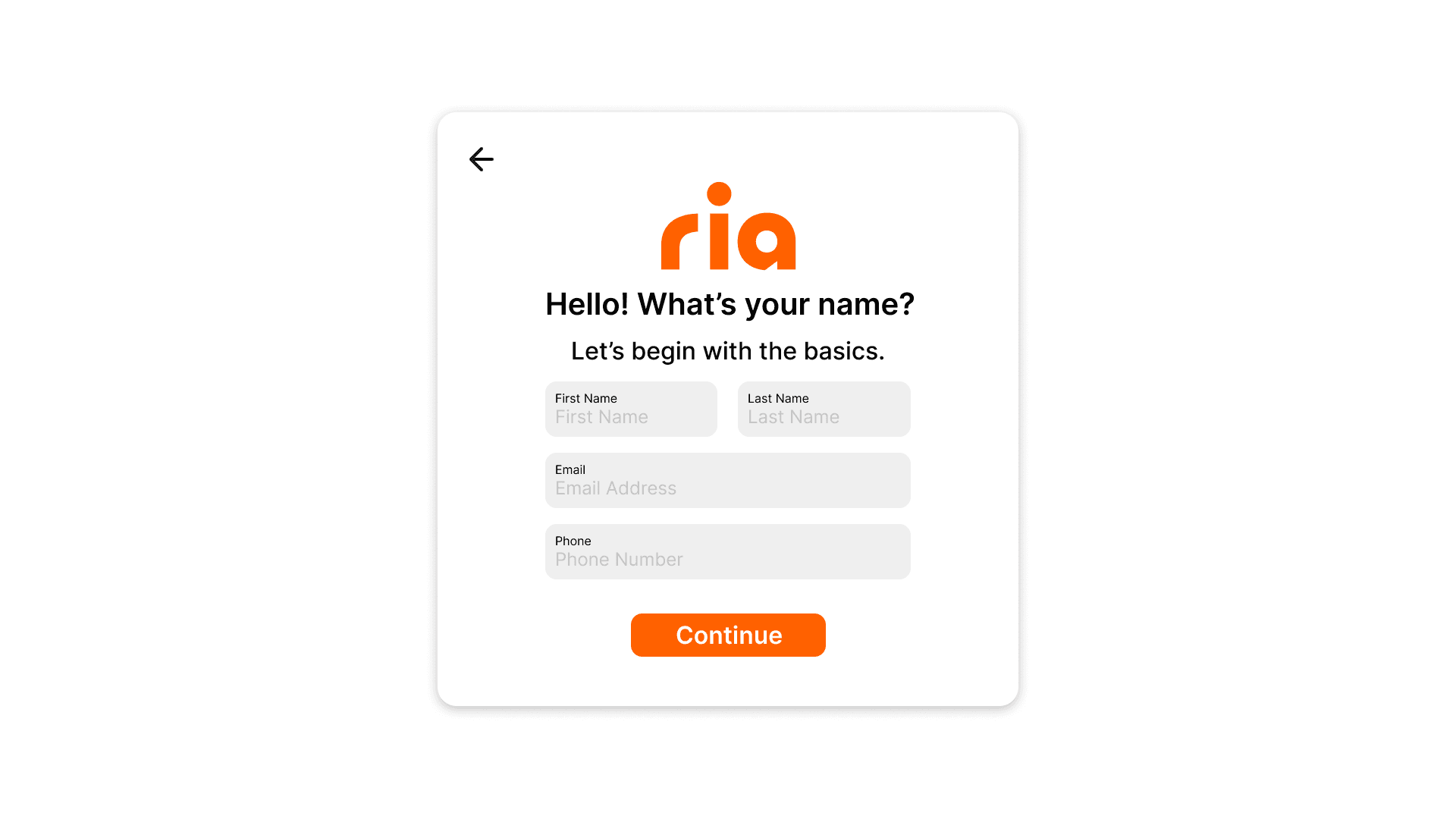

As a user, I want to enter my personal information to create an account.

As a user, I want to verify my identity to comply with regulations.

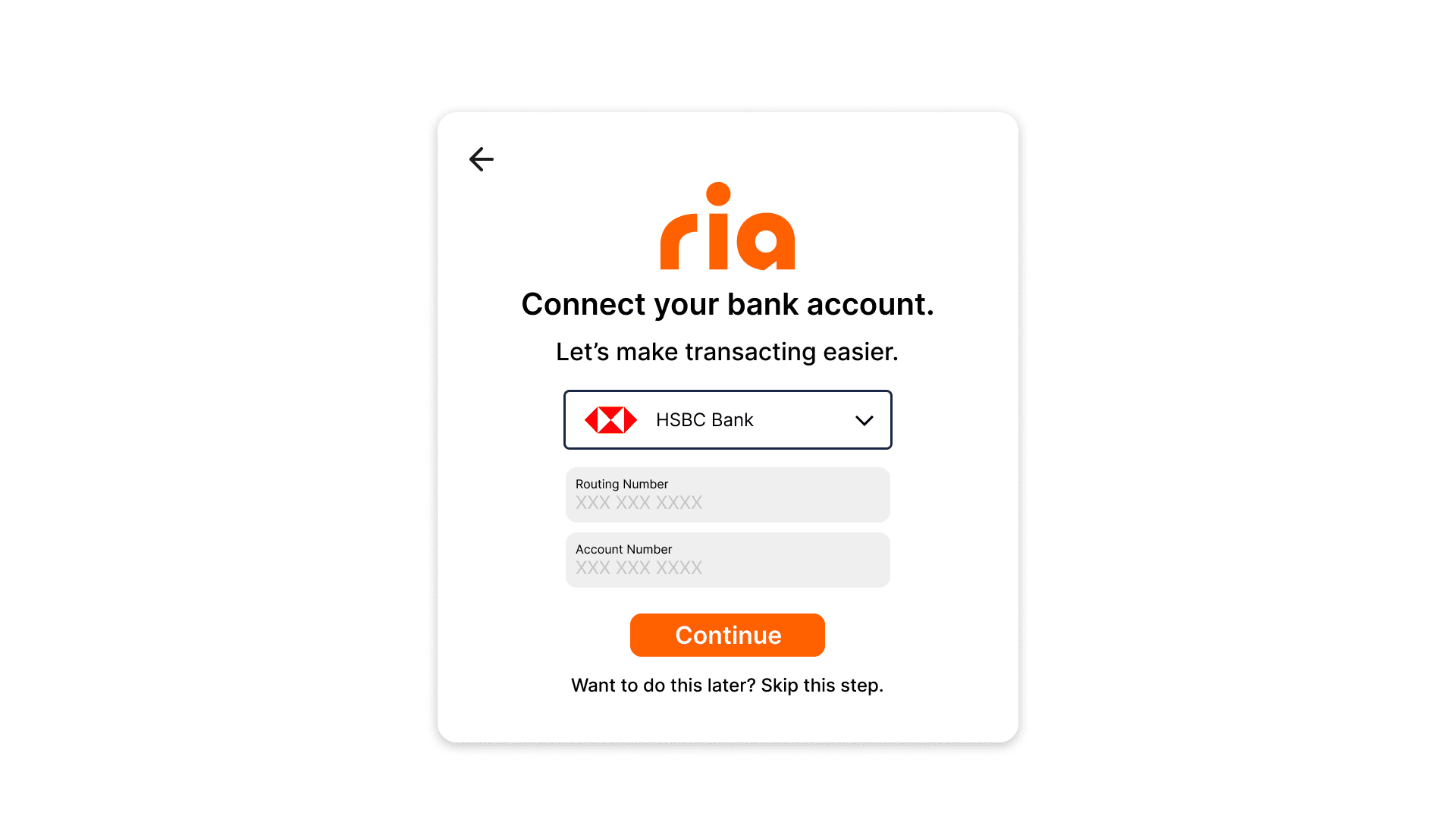

As a user, I want to link my bank account to fund my wallet.

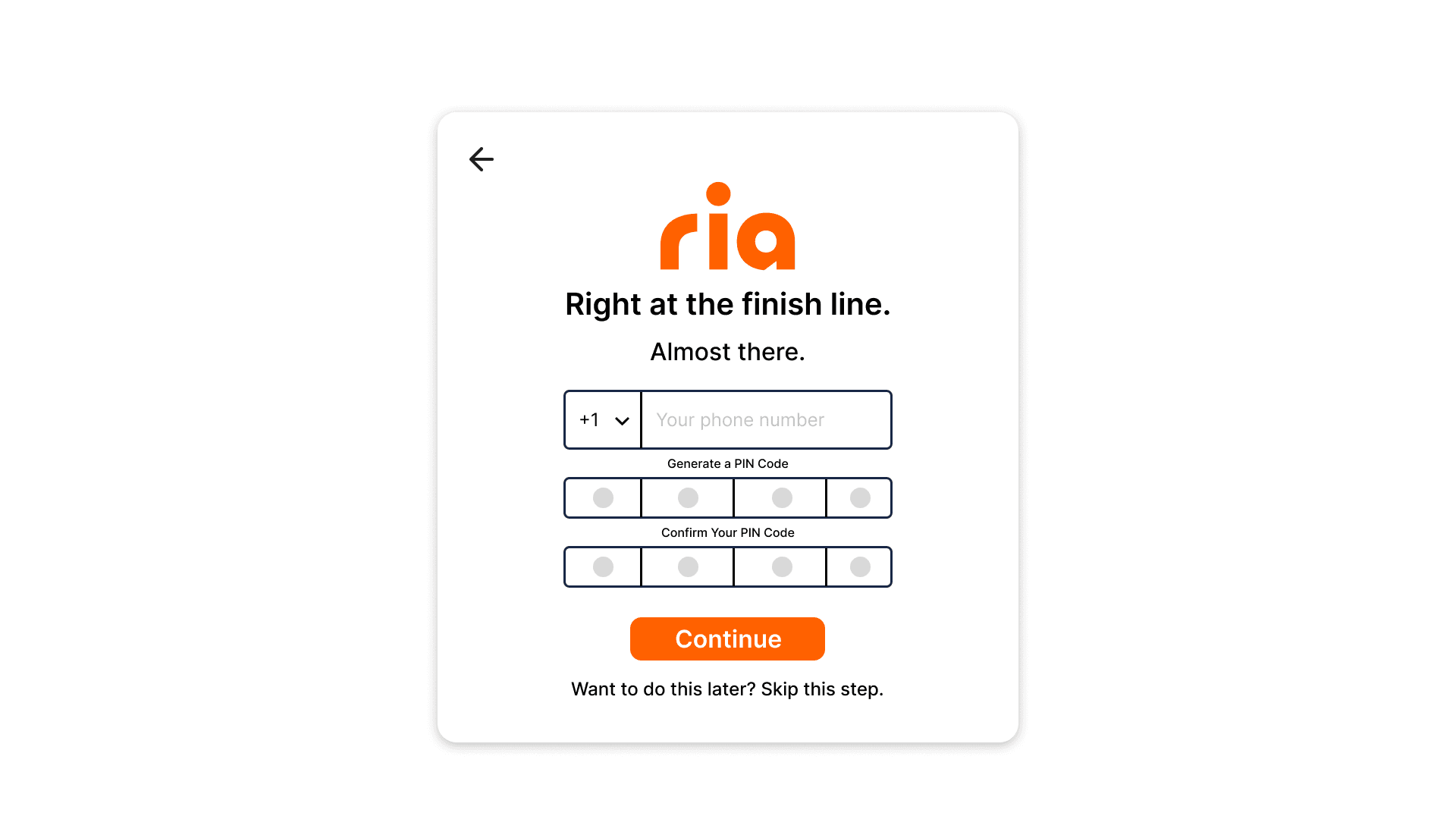

As a user, I want to set up a secure PIN to protect my account.

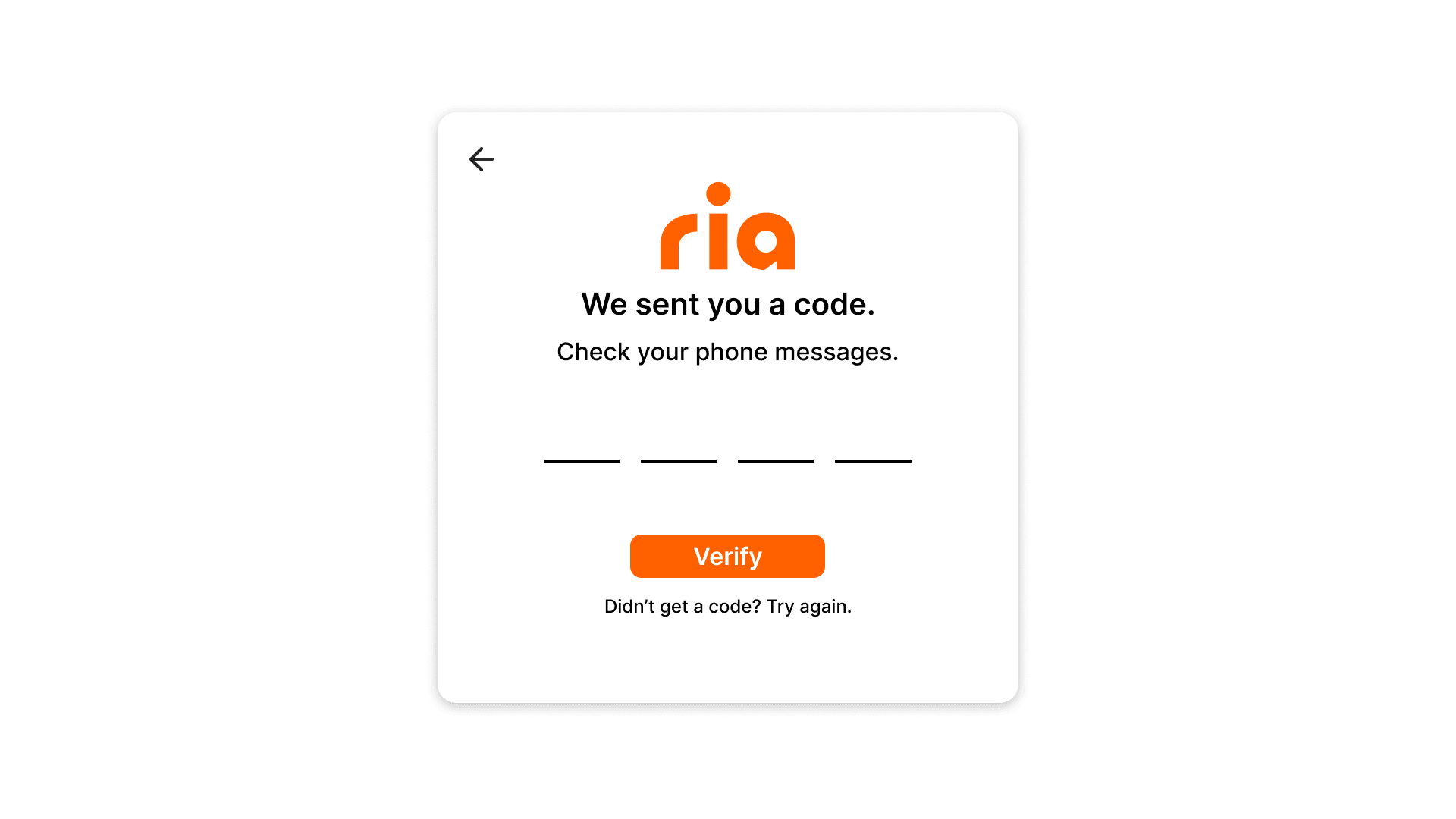

As a user, I want to verify my phone number to add an extra layer of security.

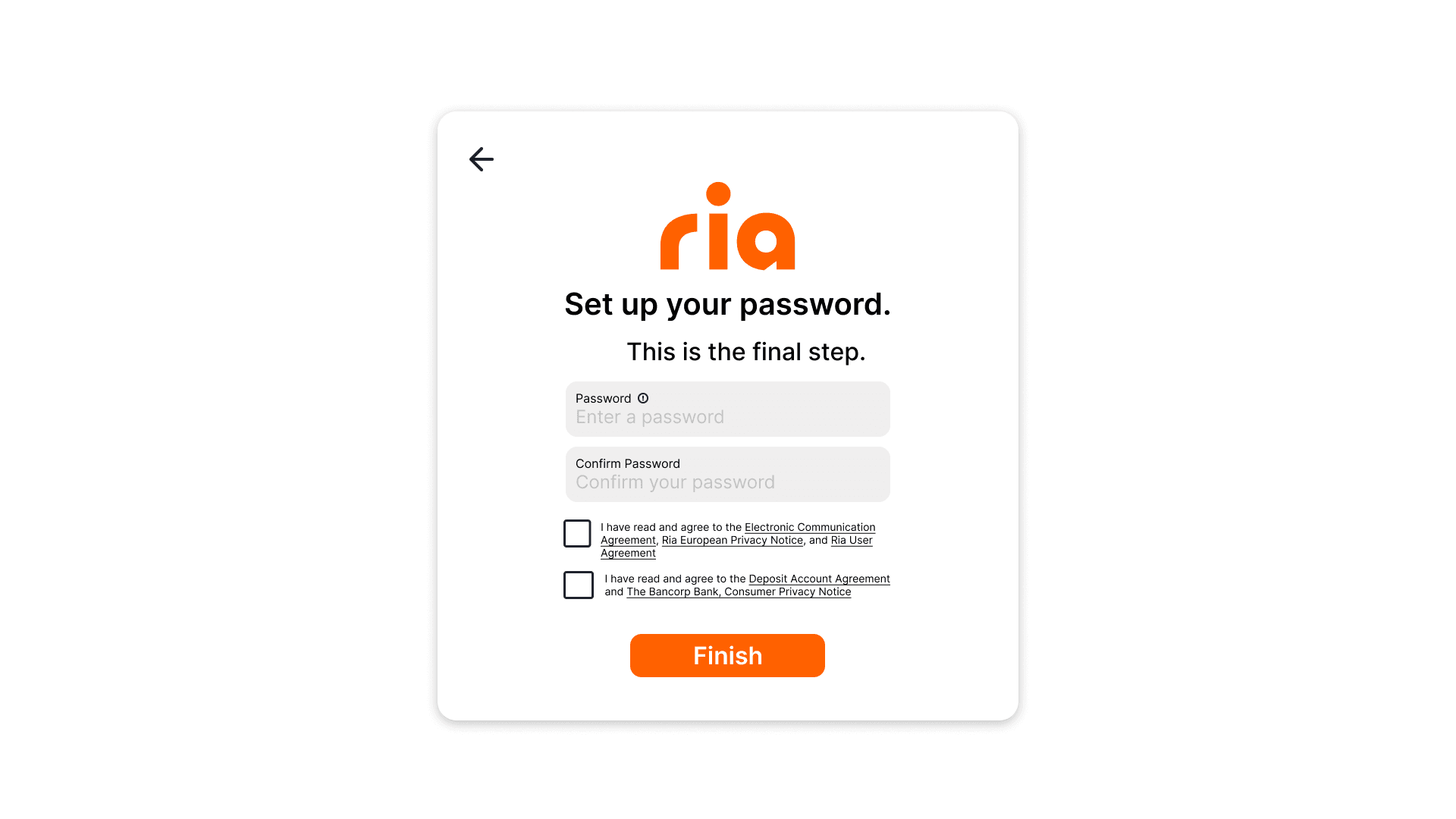

As a user, I want to create a password and accept terms to finalize my account setup.